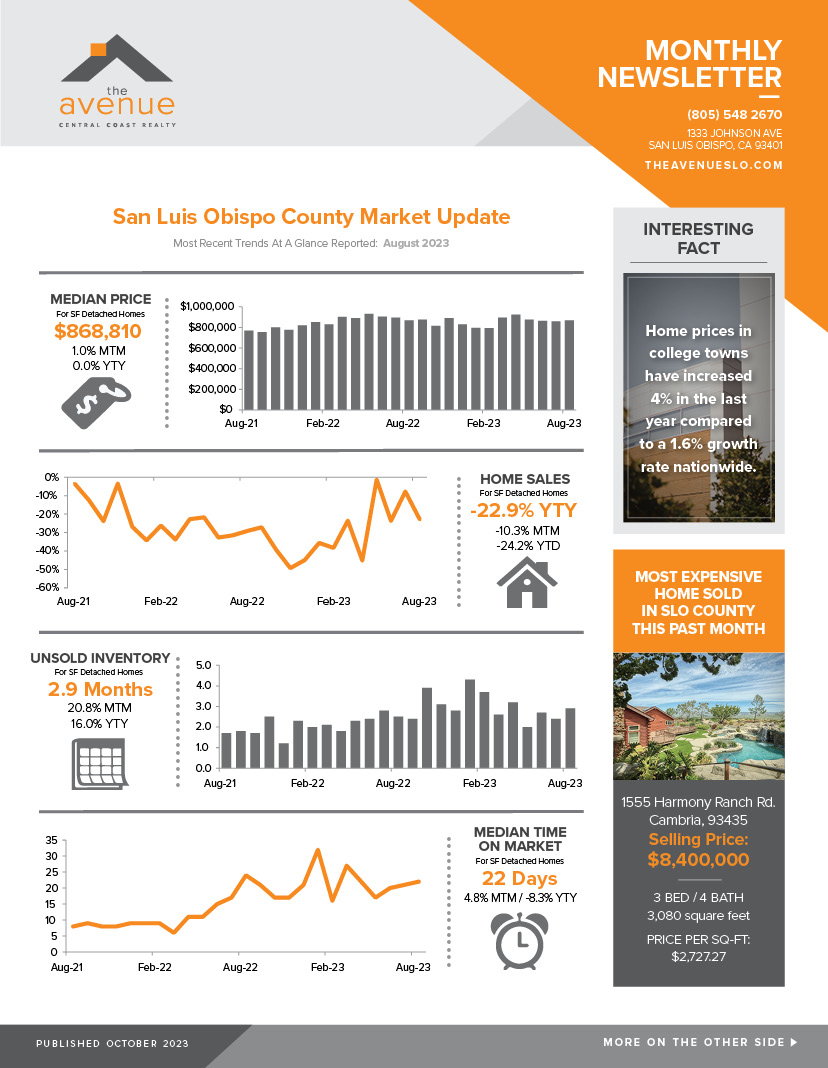

The Avenue OCTOBER 2023 Real Estate Newsletter

SLO County Market Update & great read on “Construction & Renovation Costs”

*INTERESTING FACT –

Home prices in college towns have increased 4% in the last year compared to a 1.6% growth rate nationwide.

Construction & Renovation Costs

According to a recent Harvard study, Americans spent an estimated $567 billion on home improvements and repairs in 2022, up 15% from 2021. That number is expected to reach an estimated $580 billion this year. This growth in market spending involves households at all income levels and projects of all sizes. Here we take a look at some of the key factors affecting construction costs.

Pandemic: The pandemic has had a long-term impact on material costs in construction. COVID-19 significantly disrupted global supply networks, resulting in raw material shortages and higher transportation costs. The widespread adoption of working from home changed the way people used their living spaces and encouraged massive investments in improvements and repairs. As work, school, exercise and entertainment took place at home, homeowners made updates to accommodate these activities. In 2021, more than two-thirds of remodeling market spending went to improvements of owner-occupied homes, with an additional 15% to routine repair projects. Low interest rates, increased savings, and considerable home equity gains further encouraged a demand for remodeling activity.

Housing Market and Interest Rates:Cash from savings is the most common source of home improvement funding and record-high savings during the pandemic contributed to phenomenal growth in construction activity. Rapid home appreciation has created a tremendous boon for homeowners as well, allowing them to accumulate record levels of home equity. Federal Reserve data show that aggregate home equity in the US grew fully 51% from 2019 through the third quarter of 2022. Homeowners gained an average of more than $100,000 in equity over this period.

Now, with historically high mortgage rates, more homeowners are staying put. According to Houzz, an online home renovation marketplace, “For many, conditions like limited choices of available homes and rising interest rates are driving them toward renovations and improving their current home, since the cost of moving into a house that fits their current needs has become so expensive.”

Aging Housing Market: In 2021, the median home was 43 years old. The highest it’s ever been. Given the aging housing stock nationwide, the most common system upgrades for people currently remodeling their homes include electrical, plumbing, heating and security. Our nations aging homes are in growing need of core replacements, such as roofing, windows, and HVAC systems, in addition to routine maintenance.

Demographics: Rising numbers of older homeowners are modifying their homes for improved accessibility and safety. At the same time, members of the huge millennial generation are moving through prime ages for first-time homebuying and the subsequent remodeling that results from a home purchase.

Skilled Worker Shortage: According to Associated Builders and Contractors (ABC), the construction industry needs about 546,000 additional workers to keep up pace for 2023. They say too few younger workers are entering the skilled trades, meaning this is not only a construction labor shortage but a skills shortage. “With nearly 1 in 4 construction workers older than 55, retirements will also whittle away at the construction workforce.” Looking forward they say in 2024, the industry will need to bring in more than 342,000 new workers on top of normal hiring to meet industry demand, and that’s presuming that construction spending growth slows significantly next year.

Geopolitics: The recent Infrastructure Investment and Jobs Act and Inflation Reduction Act provide incentives and assistance to households seeking to retrofit homes for energy efficiency or resilience to the effects of climate change. These acts are expected to support long-term gains in home improvement spending.

Although it’s difficult to predict, renewed conflict in parts of the world that produce a considerable amount of global energy may also put pressure on construction prices in the months ahead.

Material Costs: Although prices for key input commodities should continue to fall in 2023 and 2024, according to a report from Oxford Economics, the level still remains greatly elevated compared to pre-pandemic. About 82.5% of all construction materials experienced a significant cost increase since 2020, with an average jump of 19%, according to a construction materials report from construction cost data tracking firm Gordian. Some of the most notable material price increases compared to February 2020 include brick and clay tiles (up 25.5%), concrete products (up 27.9%), iron and steel (up 55.9%), and lumber and wood products (up 28.7%). The single largest construction commodity increase is natural gas (up 219.4%) while the smallest increase is softwood lumber (up 17%). Houzz found that the median cost of revamping a kitchen and main bathroom (the two most popular renovations homeowners undertake) is $20,000 and $13,500 respectively. That’s an increase from $12,000 and $8,000 in 2020. The director of data operations at Gordian noted, “Although we’re in the middle of a downswing from historic pricing peaks in 2022, it’s likely that increasing demand for construction will sustain materials and labor pricing through 2024 and 2025.”