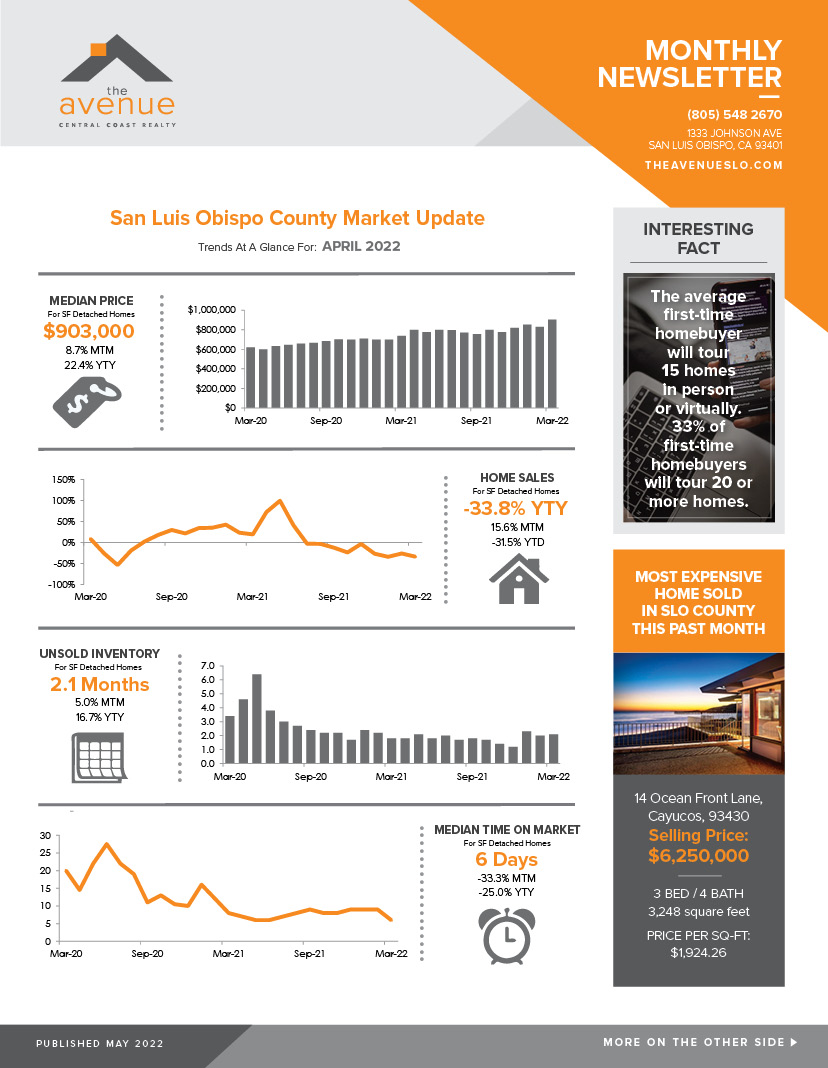

SLO County Market Update / Construction Supply Chain Issues

Since the beginning of the pandemic, global supply chain issues have rocked numerous industries, but none nearly as hard as the construction business. Pricing, lead times and availability of many of the most crucial materials for construction and home renovation projects are increasingly unpredictable.

Lumber: The pandemic both slowed sawmill production and triggered a boom in demand. Supply chain issues and a trade dispute with Canada caused prices to skyrocket. Although prices are currently dropping slowly, the lumber market is still so volatile that there’s no confidence that they will continue in a downward motion. A sheet of plywood that cost $17 in 2020, is now $100.

Concrete Products: Prices have steadily increased since early in the pandemic. In 2021, the producer price index increased by 7.6%, growing another 4% just a few months into 2022.

Gypsum: Gypsum products (which include ceiling tiles, plaster, and drywall) saw a decline of 1.3% at the beginning of 2022, however they were up 20.7% in just 12 months.

Structural Steel: Russia & Ukraine collectively contribute around 60% of the U.S.’s imports of pig iron. Although prices had started to soften over the last 6 months, the past 6 weeks have seen Hot Rolled Coil (HRC) steel up 10% over the past 30 days. It’s worth noting that the U.S. and the U.K. recently reached an agreement to roll back section 232 tariffs of 25% on steel.

The recent consumer price index released by the U.S. Bureau of Labor Statistics (BLS), showed inflation rates for consumer items rose at a rate of 7.9% between February 2021 to February 2022; the most significant increase in more than 40 years.

Appliances: According to recent data, appliance prices are up 7.3% in one year. This includes kitchen appliances, as well as washers and dryers and other major home equipment.

Insulation Materials: Up 17.8% from early 2021—with a 5.4% increase since November—various insulation products continue to show an increase in overall cost.

PVC Fittings: The resin market remains volatile as energy oil prices have surged due to the Russia/Ukraine conflict.

Hardware & Tools: Building hardware and tool prices continued to rise throughout 2021 and most recently saw an increase of 8.7% from February 2021 to one year later, according to the U.S. Bureau of Labor Statistics.

Paint: The price increased 30.3% for exterior paint and 21.2% for interior products in a single year. The price of architectural coatings also went up 20.3% from 2021 to 2022.

Furnishings: According to the BLS, the cost of living room, kitchen, and dining room furniture went up an average of 2% per month for a total change (unadjusted for seasonal increases) of 19.9% in a year.

Tiles: Ukrainian clay is especially imperative for creating bright white and large format tiles. Currently, these precious resources are sitting beneath a war-zone, making them impossible to mine. Low supply is projected to cause price increases by the fall.

additional items Affected: Millwork, cabinetry, roof tiles, electrical products (especially those using semi-conductors and microchips), solar panel, garage doors, windows.

Contributing Factors

In 2020, the pandemic shuttered factories while simultaneously created more demand, while consumers turned their focus to the very homes they were stuck in. 2021 brought a timber and plaster shortage, as well as transportation bottlenecks at ports and a record deficit of 80,000 truck drivers that continued to drive up costs. By the end of 2021, just when the industry was no longer experiencing high levels of demand and the shortage of drivers was easing, the war in Ukraine began to reverse that progress. The true impact of the war and resulting sanctions will take time to materialize, however the rising cost of fuel and disrupted supply chains brought on by the war, hit at the same time as record inflation and new lockdowns in China (due to recent Coronavirus outbreaks) have hampered production. Meanwhile, the construction industry itself is experiencing a labor shortage with an aging workforce retiring out of the profession and low numbers of new hires entering into it.

Interesting Fact

The average first-time homebuyer will tour 15 homes in person or virtually. 33% of first-time homebuyers will tour 20 or more homes.