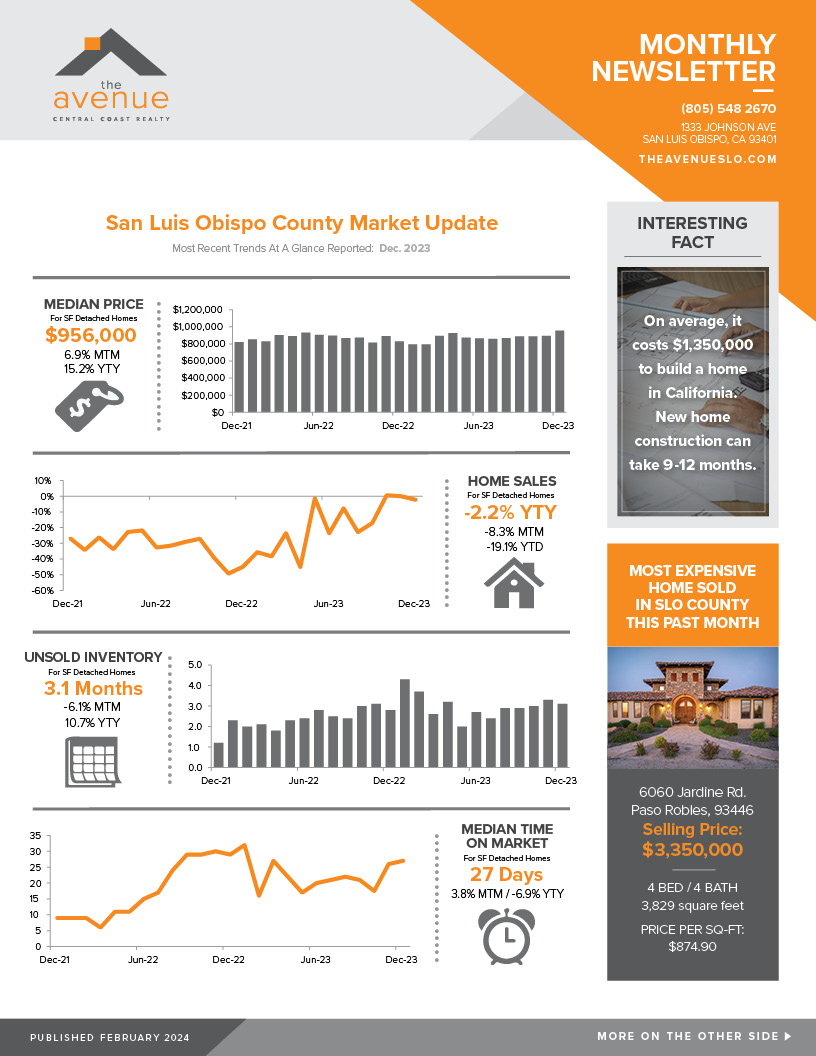

The Avenue Central Coast Realty FEBRUARY 2024 Real Estate Newsletter

SLO County Market Update & great read on “A Guide to Prop 19″

*INTERESTING FACT –

On average, it costs $1,350,000 to build a home in California. New home construction can take 9-12 months.

A Guide to Prop 19

Prop 19 is referred to as “The Home Protection for Seniors, Severely Disabled, Families, and Victims of Wildfire or Natural Disasters Act”. This law allows those that qualify, the opportunity to carry their low property tax assessments with them when they move. At the same time, Prop 19 repeals the tax benefits once granted to parents and grandparents passing property to their children and grandchildren. Inter-family transfers are no longer exempt from reassessment. We break down the dual effects of this proposition below:

Inter-Generational Transfers:

Under the old law, grandparents (Prop 193) and parents (Prop 58) were able to transfer residential & commercial properties to their children and grandchildren without any change to the property tax bill. With Prop 19 however, these old laws are repealed and the same properties will be reassessed to market value at the date of the transfer and taxed accordingly. Farms and homes that become

the principal residence of the new owners are exempt from this reassessment, unless the property value is more than $1 million over the original tax basis. In which case, upward adjustments to the tax value will be made.

- Must be the principal residence of transferor and transforee

- Value limit of current taxable value plus $1,000,000

- Only applies to family homes and farms

- There is no longer an exclusion for other real property other than the principle residence

- Parent(s) of grandchild, who qualifies as child(ren) of grandparent, must be deceased on date of transfer

- File for homeowners’ exemption within 1 year of transfer

- File claim for exclusion within 3 years or before transfer to third party

Over 55, Severely Disabled & Victims of Wildfire:

Prop 19 enables homeowners over 55, the severely disabled and those who have had their homes substantially damaged by wildfire to transfer the taxable value of their primary home to a replacement property anywhere in California. That transfer can be to a property of any value, however if the replacement property is to a higher value home, then an adjustment is made. The timeframe for the benefit is within two years of the prior property’s sale, but can be used up top three times (or more for those who have had their homes destroyed by fire).

When the replacement property is of higher value than the property that is being sold, the new taxable value is calculated by adding the difference between the full cash value of the replacement property and the original property, to the original taxable value. For example: if a home with a cash value of $400,000 and an original taxable value (or “factored base year”) of $100,000 at time of sale, is replaced by a home with a full cash value of $600,000, the difference of $200,000 is added to the factored base year of $100,000. Thus, the replacement home will have a new taxable value of $300,000.

- Only applies to a principal residence

- Must purchase or newly construct the residence within 2 years of sale

- Can be anywhere in California

- Can be any value

- No adjustment to transferred base year value if the replacement property is of equal or lesser value than the original property’s market value. “Equal or lesser value” means: 100% if replacement purchased/newly constructed prior to sale, 105% if replacement purchased/newly constructed in first year after sale, 110% if replacement purchased/newly constructed in second year after sale

- Any amount above “equal or lesser value” is added to transferred value

- Allowed to transfer three times

- If transferring because of disaster, it must be a wildfire, as defined, or natural disaster as declared by the Governor

For more information:

Visit boe.ca.gov/prop19 or call your local Assessor’s Office.