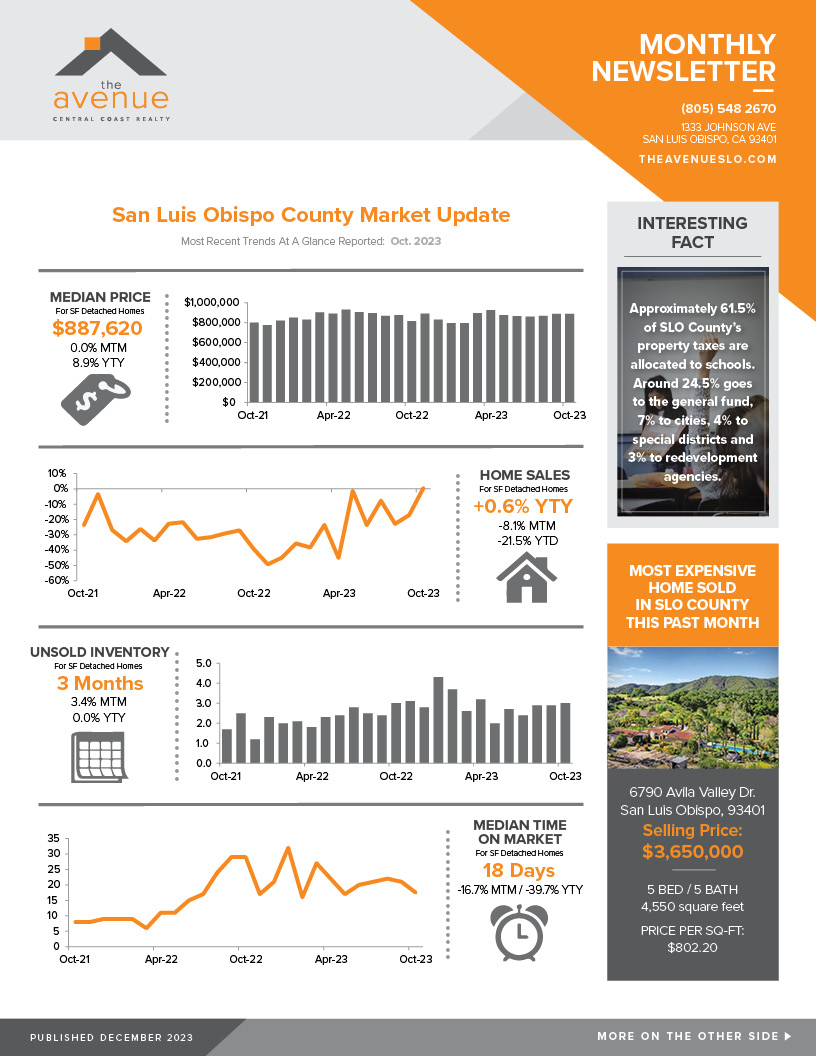

The Avenue Central Coast Realty DECEMBER 2023 Real Estate Newsletter

SLO County Market Update & great read on “The Fed & Rates”

*INTERESTING FACT –

Approximately 61.5% of SLO County’s property taxes are allocated to schools. Around 24.5% goes to the general fund, 7% to cities, 4% to special districts and 3% to redevelopment agencies.

The Fed & Rates

The Federal Open Market Committee (FOMC) holds eight policy meetings per year in which they vote whether to hold steady or modify the federal funds rate. Over the last 50 years, that rate has ranged from a low of 0% to a high of 20% as the FOMC attempts to manage the economy. On the 13th of this month the Fed conducted their final meeting of the year, reporting better news than many anticipated.

Meeting Recap:

The FOMC announced that they don’t plan to raise their federal funds rate but rather hold it steady at the current rate of 5.25% to 5.50%. However, they also signaled (to the surprise of many economists), that they plan to cut interest rates in 2024, with new projections suggesting three rate cuts by the end of next year.

The Labor Department also reported that the U.S. economy added 199,000 jobs in November, exceeding economist’s expectations of 190,000 new jobs. U.S. wages were up 4% year-over-year and the unemployment rate ticked lower to 3.7% in November and remains historically low. This ease of inflation without a significant increase in unemployment implies that a “soft landing” (lowering inflation back down to a normal range without plunging the U.S. into a recession) might actually be feasible.

Currently, inflation is running 3.1% on a yearly basis, down from its peak of 9.1% in 2022. We’re also seeing solid growth, consumers continuing to spend and employers hiring. At the same time, supply chain issues are resolving, boosting inventories and easing shortages. These factors have all contributed to prices stagnating and in some areas, even coming down. Following the release of the Fed’s most recent decision, the Dow Jones Industrial Average jumped more than 400 points, surpassing 37,000 for the first time.

The Ultimate Goal:

As Fed policymakers look ahead to 2024, they are aiming for that notorious soft landing. Officials are trying to assess how long they need to keep interest rates high to ensure that inflation is fully under control without grinding economic growth to an unnecessarily painful halt. Jerome H. Powell, the Fed chair, has been careful to avoid declaring victory prematurely.

The Fed’s long-term target is a core personal consumption expenditures (PCE) price index of just 2%. That number has been above 2% for 33 straight months. It was 3.5% in October, down from 3.7% in September. The Fed uses the core PCE price index as its preferred measure of U.S. inflation because it excludes volatile food and energy prices. Investors will be watching for the November core PCE reading, which will be released on December 22nd, to confirm if inflation is still trending lower heading into 2024.

Mortgages and Home Equity:

While the federal funds rate doesn’t really impact mortgage rates, (which depend largely on the 10-year Treasury yield), they’re often moving the same way for similar reasons. With the 10-year Treasury yield falling in recent weeks, mortgage rates have gone along for the ride and dropped quickly. Mortgage rates have dropped three-quarters of a percentage point from their October peak. Currently, rates are in the 6’s and some programs even offer rates in the low 6’s.

The cost of a home equity line of credit (HELOC) should remain flat since HELOCs stay aligned with changes in the federal funds rate. HELOCs are typically linked to the prime rate (the interest rate that banks charge their best customers). Those with outstanding balances on their HELOC will likely see rates stay close to where they are currently, but it can still be a good time to shop around for the best rate.

What’s Next?

Along with the decision to stay on hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. That’s less than what the market had been pricing, but more aggressive than what officials had previously indicated. They also indicated another 4 cuts in 2025 for a full percentage point reduction. Three more reductions in 2026 would take the fed funds rate down to between 2%-2.25%, close to the long-run outlook, though there was considerable dispersion in the estimates for the final two years.

Even though current projections look promising, the Fed routinely cautions that any number of threats could ruin their plans; from war in the Middle East to China’s economic slowdown. The White House is also quick to emphasize that much work still remains.

Officials will continue to monitor incoming economic data in the weeks ahead. Federal Reserve officials have repeatedly emphasized they will not begin cutting rates until they are fully convinced the battle against inflation is over. The next FOMC meeting will be held on January 30-31, 2024.