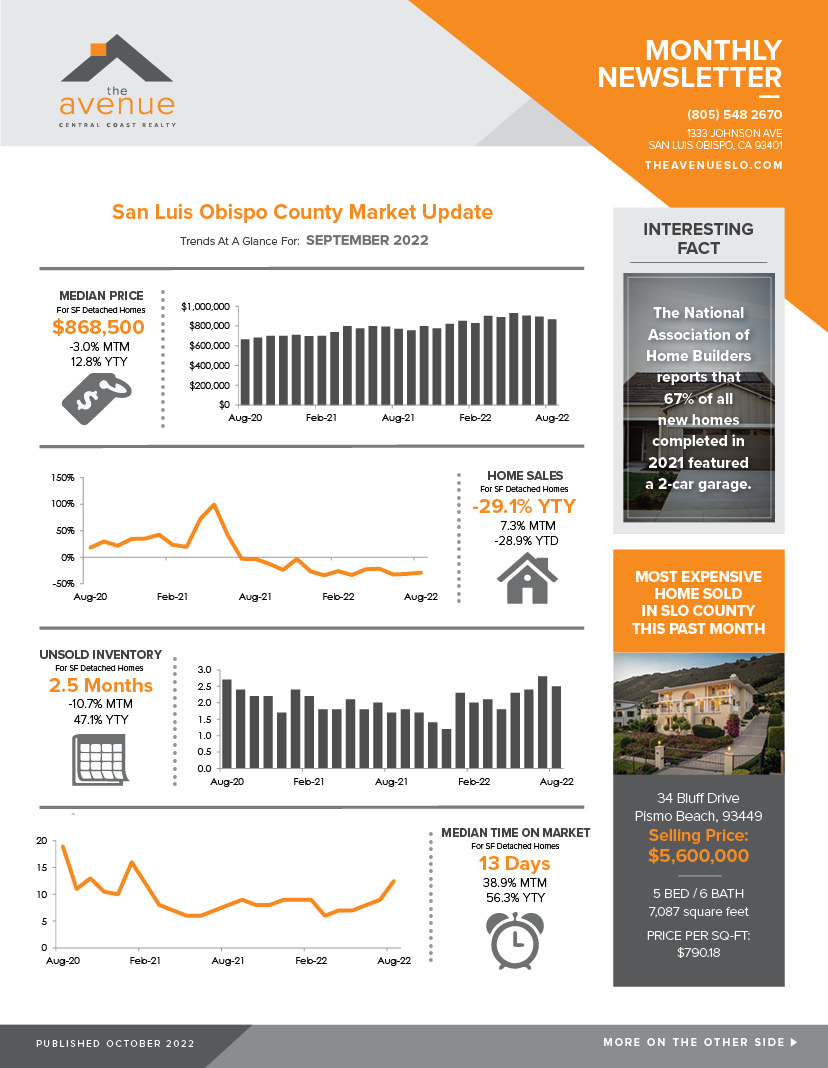

SLO County Market Update / Combating Inflation with Rising Rates

Given the past few years; a world-wide pandemic, skyrocketing home prices, rising fuel costs, record-breaking lumber price tags, a brand new war…. we would never dream of trying to predict what may happen with the current interest rate hikes. However, here’s what we’ve found the experts are saying.

The Goal:

The Fed’s recent hikes to interest rates has been an effort to cool record-high inflation, by bringing down demand. The average rate on a 30-year fixed mortgage is now over 7% and climbing. Mortgage credit availability is the lowest it has been since March 2013, when the country was recovering from the financial crisis of the previous decade. Though painful, the Fed’s intent is to drive soaring prices back down. When monetary policy becomes more restricted, there’s a ripple effect throughout the economy and depending on where you stand, it could either feel like a great thing or a raw deal.

Value of the Dollar:

When interest rates go up, the dollar becomes more appealing to investors around the world. According to CNN Business; “In any economic climate, the dollar is seen as a safe place to park your money. In a tumultuous climate — a global pandemic, say, or a war in Eastern Europe — investors have even more incentive to purchase dollars, usually in the form of US government bonds.” The dollar is now stronger than it has been in two decades. For Americans traveling abroad, this is great. However, the rising dollar has a “destabilizing effect on Wall Street” because the S&P 500 companies do business around the world. Morgan Stanley estimates that “each 1% rise in the dollar index has a negative 0.5% impact on S&P 500 earnings.”

average consumers: Americans are spending $460 more a month on groceries than they were a year ago, according to Moody’s Analytics. Prices have risen at the fastest rate in 40 years, drastically reducing consumers’ spending power. Wages also have not kept up. While spending normally ramps up at the end of the year, as we head into this holiday season, it’s unclear how things will play out. ZipRecruiter noted that they haven’t seen the normal uptick in companies hiring for seasonal help, which signals that businesses are bracing for lower earnings.

Borrowers:

Credit card debt, car loans and of course the 30-year fixed mortgage have become much more expensive. With the Fed’s plans to continue to increase rates through the end of the year, the cost of borrowing will only get more pricey. Many homebuyers have simply been priced out in markets across the country. Home prices have declined slightly nationwide, but are still higher than they were a year ago. That, coupled with an interest rate that essentially doubled over a year, has reduced the number of potential homebuyers. However, there is good news. The average wage needed to afford the average home nationwide, has fallen for the first time in almost two years. The latest nationwide median value of $340,000 is down 3% from the second quarter of 2022 – the first Spring-to-Summer decline since 2008. By reining in inflation, home affordability may once again become within reach to first-time homebuyers. Historically, when interest rates go up, demand slows and values of homes come down.

Sellers:

Since interest rates have risen so drastically this year, many sellers are being forced to reduce their asking prices in order to sell their homes. The good news is that the limited inventory of homes is keeping those prices higher than they might otherwise be. Traditionally, a large inventory favors the buyer and with the current inventory levels, sellers aren’t faring as bad as they could be. Many people have compared the current recession to that of 2008, however they forget that the market was inundated with inventory at that time, as sellers were being forced to offload their homes due to predatory lending practices. That’s not the case today. Sellers are also seeing many all-cash offers, as buyers try to side-step interest rates all together.

Savers:

For those that are big on saving, there’s an opportunity to finally seeing a meaningful return. According to Bankrate data, the average yield on a savings account has more than doubled since the Fed’s first rate hike in March.

For people planning on big purchases like a car or a renovation in the next 12-18 months, a short-term certificate of deposit might be a good choice, if you’re able to lock in your rate. CDs generally offer a higher return than a regular savings account, while avoiding the volatility of the stock market. Many people are also looking towards Series I bonds. This is where a financial advisor can be your best asset yet.

Interesting Fact:

The National Association of Home Builders reports that 67% of all new homes completed in 2021 featured a 2-car garage.