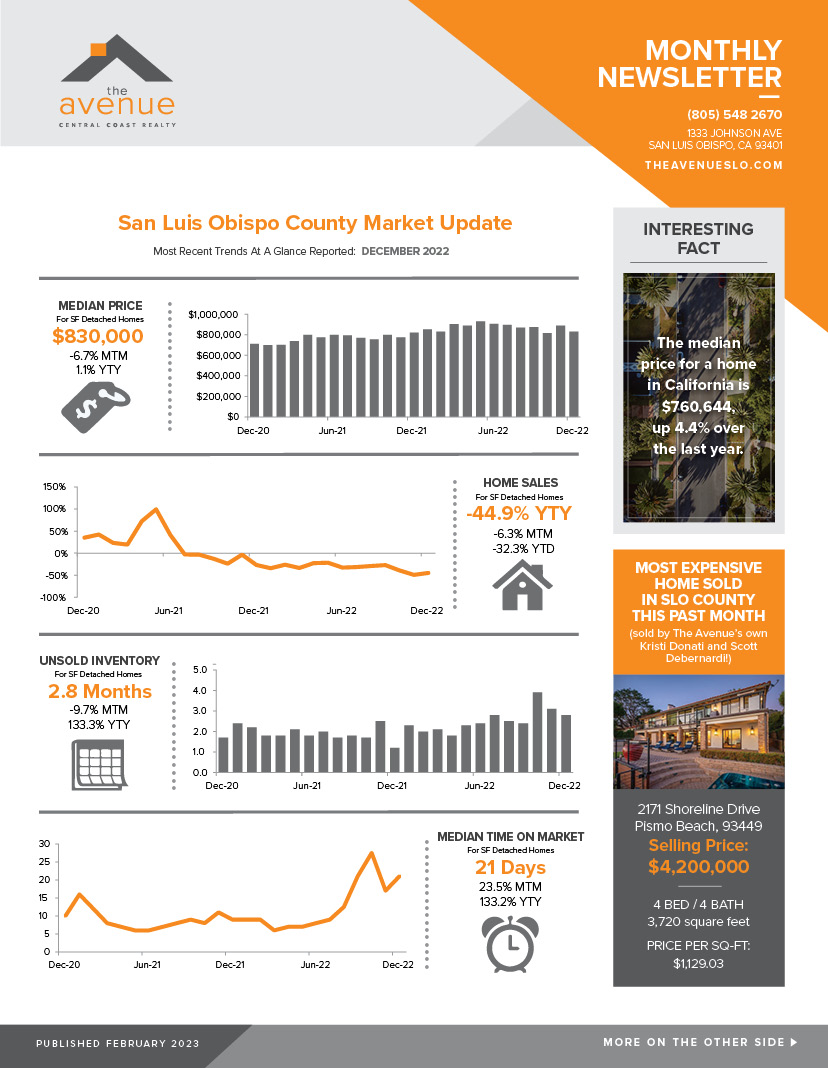

SLO County Market Update / 2023 Real Estate Projection

As Realtors®, it’s our job to stay on top of real estate news and inform our clients when risk or opportunity are present in the market. With the fluctuation of interest rates, inflation hitting consumer’s pocketbooks and a nation cautiously attempting to sidestep a recession; there are too many factors to comfortably promise anything. We know the only good prediction is the one that ends up being correct. So rather than predict, we’re giving you our projection for Central Coast real estate in 2023 and like any good projection, we’ll adjust accordingly with the ever-changing economic environment.

Inflation & Interest Rates:

The housing market is intimately tied to the Federal Reserve. Last March, our overheated economy led The Fed down a path of raising borrowing rates. The steady increases have really been felt in the real estate market, with transactions stalling. Potential homebuyers are feeling defeated and potential sellers feel stuck. Most forecasters predict prices will fall as the interest rates are increased, although the rate at which those prices are expected to fall is all over the board.

Realtor.com predicts that home prices will rise 5.4% in 2023. NAR (National Association of REALTORS®) projects that home prices will rise 1.2%. Freddie Mac expects prices to fall 0.2%, Fannie Mae says they’ll fall closer to 1.4% and Morgan Stanley says they’ll actually go down 10%.

One thing we do know for a fact, is that inflation has cooled down the housing market. Houses are listed for sale longer and price drops are slowly starting to happen. When interest rates do drop, (and they’re slowly starting to) a higher inventory of homes on the market will naturally follow as sellers will be more willing to give up their currently low interest rates, for something only slightly higher.

How low can you go?

According to Fortune Magazine, the median home price nationwide rose for 124 consecutive months from February 2012 to June 2022, with a decline of 2.4% between June and October of last year, and a slow decline each month since. However, the drop in prices that buyers have been waiting for hasn’t hit yet.

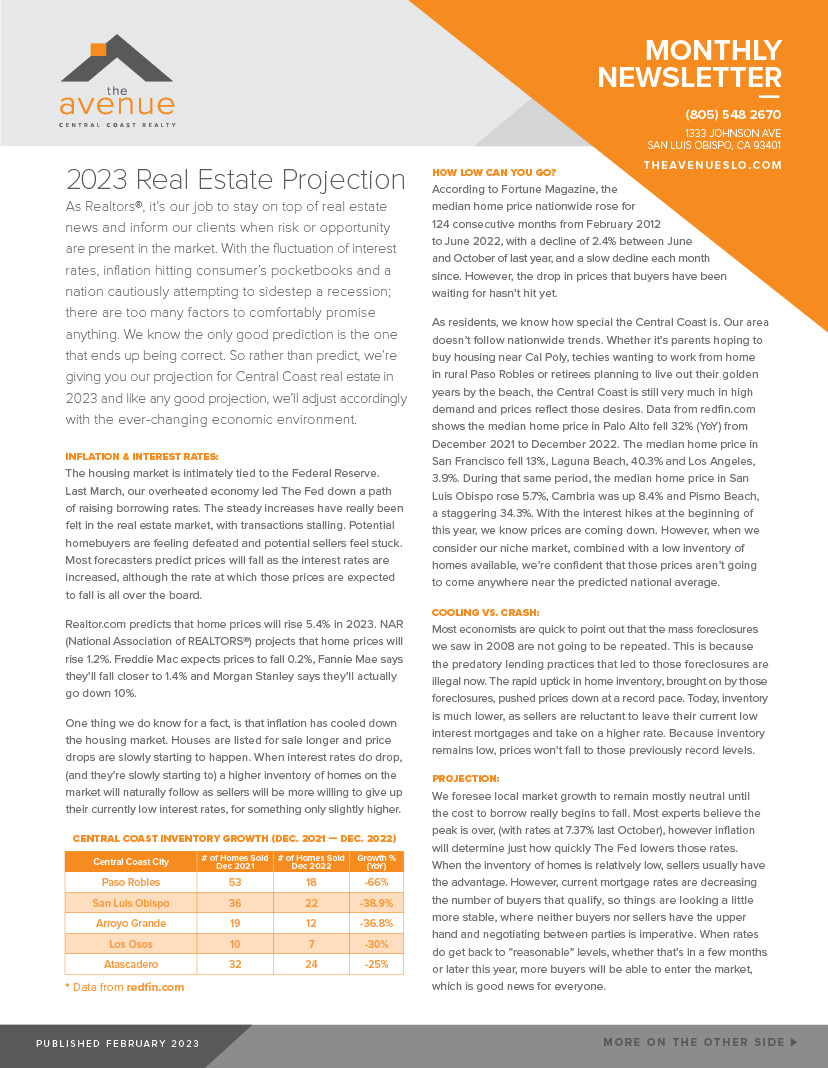

As residents, we know how special the Central Coast is. Our area doesn’t follow nationwide trends. Whether it’s parents hoping to buy housing near Cal Poly, techies wanting to work from home in rural Paso Robles or retirees planning to live out their golden years by the beach, the Central Coast is still very much in high demand and prices reflect those desires. Data from redfin.com shows the median home price in Palo Alto fell 32% (YoY) from December 2021 to December 2022. The median home price in San Francisco fell 13%, Laguna Beach, 40.3% and Los Angeles, 3.9%. During that same period, the median home price in San Luis Obispo rose 5.7%, Cambria was up 8.4% and Pismo Beach, a staggering 34.3%. With the interest hikes at the beginning of this year, we know prices are coming down. However, when we consider our niche market, combined with a low inventory of homes available, we’re confident that those prices aren’t going to come anywhere near the predicted national average.

Cooling vs. Crash:

Most economists are quick to point out that the mass foreclosures we saw in 2008 are not going to be repeated. This is because the predatory lending practices that led to those foreclosures are illegal now. The rapid uptick in home inventory, brought on by those foreclosures, pushed prices down at a record pace. Today, inventory is much lower, as sellers are reluctant to leave their current low interest mortgages and take on a higher rate. Because inventory remains low, prices won’t fall to those previously record levels.

Projection:

We foresee local market growth to remain mostly neutral until the cost to borrow really begins to fall. Most experts believe the peak is over, (with rates at 7.37% last October), however inflation will determine just how quickly The Fed lowers those rates. When the inventory of homes is relatively low, sellers usually have the advantage. However, current mortgage rates are decreasing the number of buyers that qualify, so things are looking a little more stable, where neither buyers nor sellers have the upper hand and negotiating between parties is imperative. When rates do get back to “reasonable” levels, whether that’s in a few months or later this year, more buyers will be able to enter the market, which is good news for everyone.

Interesting Fact:

The median price for a home in California is $760,644, up 4.4% over the last year